- Home

- Campervan Insurance

- pay as you go

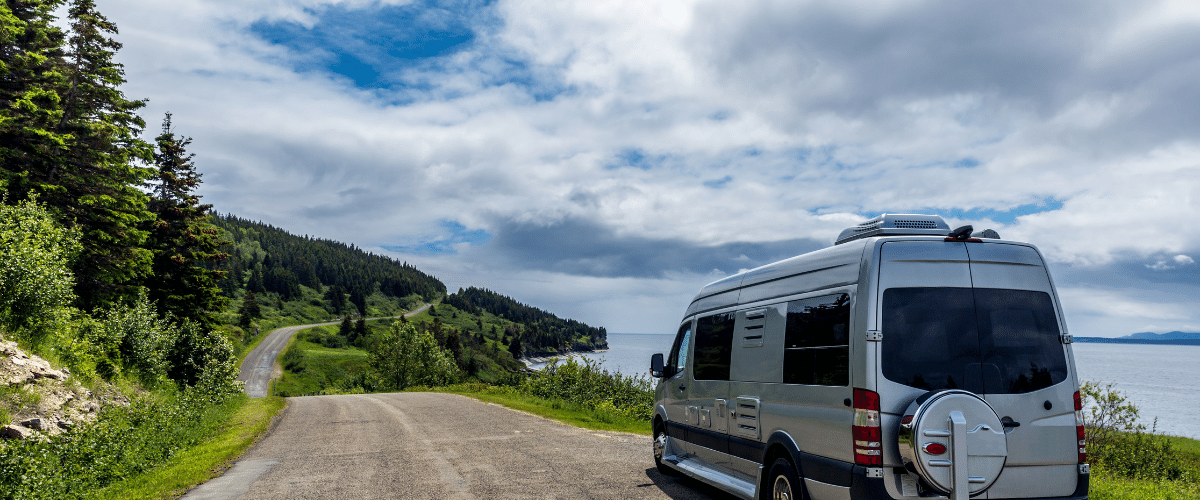

pay as you go campervan insurance

Pay as You Go Campervan Insurance: How to buy your insurance on a day or a monthly basis.

Let’s have a look at pay as you go campervan insurance and why some campervan owners think it’s a brilliant policy because you only pay for when you use the van, isn’t that great?

Understanding Pay as You Go Campervan Insurance

Most van insurance policies require that you pay for six months or a full year in advance, but there are also options available for pay as you go van insurance.

There are a variety of different types of van insurance available to the average consumer, one of which is pay as you go van insurance. What sets this type of insurance apart from others is the fact that pay, as you go camper insurance, is paid on a month by month basis, and sometimes requires a deposit, rather than being paid on a six month or twelve-month basis without requiring a deposit.

The Popular Option for Campervan Owners

Pay as you go van insurance is a popular option for some people but is not the ideal type of van insurance for everyone. There are certain circumstances where pay, as you go van insurance, will be ideal because it allows you to purchase van insurance as you need it, rather than being forced to buy so far in advance.

- If you do not plan on having your van for long because you plan on selling it or because you are only leasing, then pay as you go van insurance may be ideal.

- Are you trying to decide whether or not pay as you go van insurance is right for you? Here are some considerations to make in order to arrive at the answer that you seek:

- If you can afford to buy your van insurance in advance and plan on keeping your van for a year or longer, traditional van insurance is probably preferable.

If you would rather pay a deposit and then just pay the monthly premium rather than a lump sum, or if you do not know if you will be keeping your van for long, pay as you go van insurance may be ideal.

I hope this article helps you find a better policy for your campervan. If you find it helpful help like us on Facebook or send a Tweet on Twitter and we’ll really appreciate it “big much”.

Go to the homepage of campervan insurance to find out more here.

Return to the main campervan insurance homepage.