POS & EPOS Trends 2026: The Future of Retail and Hospitality in the UK

This is the UKLI POS/EPOS Trends 2026 page, dedicated to the ever-changing card processing trends.

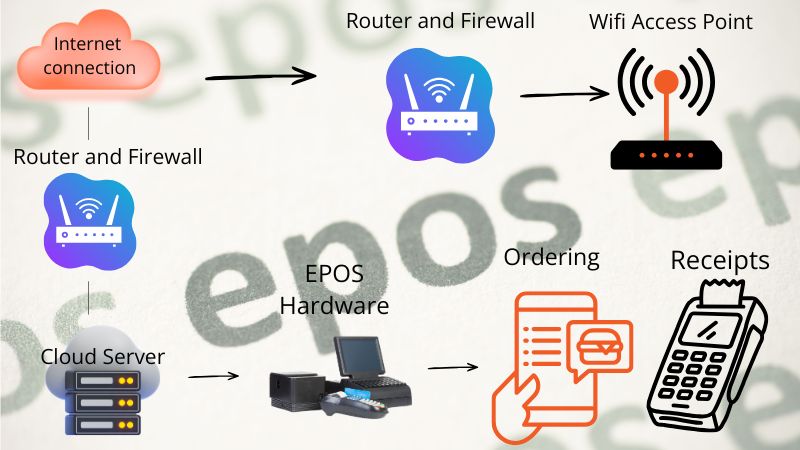

We look at Point of Sale (POS) and Electronic Point of Sale (EPOS) systems and the way they have evolved far beyond the simple cash registers of the year 2000. They are now much more intelligent, connected platforms with AI integration and advanced software. They seamlessly connect across multiple systems, driving business payments efficiency and better customer loyalty.

Growth for UK retailers and hospitality businesses is all go, helping them thrive and operate smarter.

On our annual POS/EPOS trends and guide page right here, we'll post the most important and relevant information for POS and EPOS systems to let you know what's happening with hardware and software upgrades and guides on who's the best provider to go with for the current year. You can bookmark this page or link to it if you know how from this page to a page on your site or blog.

We'll update this page every year as technology advances.

Key POS/EPOS Statistics for 2026

UK Retail & Hospitality Focus

Market Size Projections 2026

Bars scaled relative to the Broader UK POS Market

Merchant Payment Acceptance 2026

| Statistic | Value | Insight / Source |

|---|---|---|

| UK POS Software Market Projected Size (2026) | ~£950 million | Projected from recent reports; growing at ~9.4% CAGR driven by cloud, AI, and omnichannel adoption (Grand View Research / industry data) |

| Broader UK POS Market Projection (2026) | ~£1.76 billion | Includes hardware and software across retail & hospitality (Fortune Business Insights) |

| Merchants Accepting Contactless/Tap-to-Pay | 84%+ | Near-universal adoption; contactless dominates transactions (Epos Now / takepayments / UK Finance 2025-2026 data) |

| Merchants Still Accepting Cash | Around 87% | Most businesses support multiple payment methods; cash remains available but usage continues to decline (UK Finance / industry surveys) |

| Estimated Cash-Only Businesses | Less than 11% to 15% | Very few fixed-location retail/hospitality venues operate cash-only; digital/card payments are essential (industry trends 2025-2026) |

GBP figures are approximate (based on early-2026 exchange rates).

Data compiled from Grand View Research, Fortune Business Insights, Epos Now, UK Finance, and recent industry reports.

1. AI-Powered Intelligence and Personalisation

Now here's something exciting – Artificial Intelligence in UK POS/EPOS systems.

Right now, teams at the top card processing companies and the big banks are working hard on important challenges like shoplifting prevention, predictive inventory (giving you 'eyes on the back of your head'), dynamic pricing for customers with store and loyalty cards, personalised recommendations, and advanced fraud detection – all delivering real advancements in AI.

Why it matters for UK businesses: It means less worry for owners about day-to-day operations. By reducing shoplifting and streamlining processes, AI helps cut stockouts, boost average transaction values through smart upselling, and protect businesses against increasingly sophisticated payment fraud.

We think that for very big changes, it will take a few years for AI and POS/EPOS to really change and make a difference. It will transform the retail industry big time and hopefully reduce shoplifting with dynamic barcodes and door entry systems. Meaning the EPOS system will know if an individual item has been paid for or not just by the barcode of the product, then opening the door to let customers through before they get to the door, so it doesn't seem like a prison-like shopping experience.

2. Cloud-Based Systems as the Standard

Eventually, everything will move to the cloud because it offers greater safety and security than any current alternative. All your pricing updates can be applied instantly, adjusted in seconds to suit discounts and offers, which will automatically be applied to the products you select. Such as those nearing their sell-by dates – using machine learning within the cloud-based EPOS system.

Why it matters for UK businesses: Every single update and advance in POS and EPOS is aimed at making businesses make more money, by securing inventory, monitoring staff, integrating into the stores' CCTV system, you name it. And in the cloud means fewer server crashes during peak trading times, and all data is in one place for TAX to what's in stock. All managed from your iPad, which will be crucial for seasonal businesses or chains.

In 2026 and beyond, the majority of new EPOS installations are cloud-based, delivering real-time data access, instant updates, and seamless multi-site management.

3. Mobile and Flexible POS Solutions

Mobile devices like iPads, Android phones, iPhones, and tablets – which most small businesses prefer – make life a lot simpler. Do you know mPOS and SoftPOS let you take payments on phones, tablets - anywhere.

Why it matters for UK businesses: They allow you to take payments anywhere and everywhere, reduce queues, improve customer service, and support the growing trend of experiential retail and outdoor/events trading. Even if you run a pressure-washing or roofing business, capturing customer payments on site is no problem at all.

Some small business owners still think in their head that a POS or EPOS system is a big clunky piece of hardware they need to carry around with them - but it's not anymore. It's brilliant to be perfectly honest because mobile integration with devices like iPads, iPhones, and Android devices like your Samsung smart phone makes taking card payments on the go effortless.

4. Omnichannel and Unified Commerce

Gone are the days and the differences in online shops vs in-store shops. Will the retail shop survive, and will they still be on the high street in 10 to 15 years? Who knows, but I think they will because people still like to look before they buy something - don't you like to see it before you get your cash or card out?

Why it matters for UK businesses: Modern EPOS systems keep all the inventory and orders in tables where it makes plain sense what's happening.

Synchronises everything you need - from click-and-collect orders, returns, online - in one screen.

Omnichannel and unified EPOS systems are often seen as being for the “big boys” because a system like this never misses a trick. With data syncing, heavy stock management, full in-house data management, and cloud backups, it covers just about everything an EPOS system has to offer.

5. Advanced Payments and Security

We think contactless will be here to stay because it's a human thing, it's faster but not the safest way right now but that will improve over time. We're talking about the scams where cammers walk close to you with a card reader and swipe your card for £40 or £100 as the limits are higher after Covid. But don't worry security features like tokenisation payments and AI fraud monitoring are built-into all POS and EPOS systems as standard.

Why it matters for UK businesses: The obvious benefit is faster checkouts, although some systems are still slow – like the local one I use in Motherwell at the One Beyond supermarket. It's a brilliant shop, but their EPOS system is slower than Asda across the road. Advanced payments bring happier customers and stronger protection against fraud.

Looking Ahead to 2027 and Beyond

At this pace, you'll see big changes right up to 2030 with advanced EPOS and till systems that work with UK businesses even better to make them more money. Watch out for AI, and if it works the way we think it will, with EPOS, it could mean no more fraud or chargebacks or the big one - no more shoplifting.

We'll update this page annually with the latest data, new EPOS trends, and more of your real-world insights.

If you want to find a POS or EPOS system for your business, we can lend a hand. Start comparing the big boys in card processing with us by visiting our EPOS quote page.

That'll get you pointed in the right direction.

Or return to the point of sale homepage for some more digging.